The Greatest Guide To Health Insurance In Toccoa, Ga

Six out of every 10 uninsured grownups are themselves utilized. Working does enhance the chance that one and one's family participants will certainly have insurance coverage, it is not a warranty. Even members of family members with two full time breadwinner have almost a one-in-ten possibility of being without insurance (9. 1 percent uninsured rate) (Hoffman and Pohl, 2000).

1 and 3. 2 (Commercial Insurance in Toccoa, GA), for further information. New immigrants make up a significant percentage of individuals without medical insurance. One evaluation has actually connected a significant part of the recent development in the dimension of the U - https://app.roll20.net/users/12945238/jim-t.S. without insurance population to immigrants who got here in the country in between 1994 and 1998 (Camarota and Edwards, 2000)

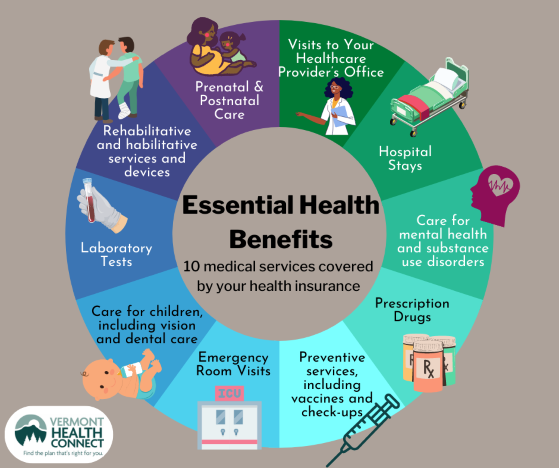

Medical insurance coverage is a crucial element in most designs that show access to health and wellness treatment. The relationship between medical insurance and accessibility to care is well developed, as documented later in this chapter. The connection in between health and wellness insurance policy and wellness outcomes is neither direct neither simple, a comprehensive scientific and wellness solutions study literary works web links wellness insurance protection to improved accessibility to care, far better high quality, and boosted individual and population health and wellness condition.

How Home Owners Insurance In Toccoa, Ga can Save You Time, Stress, and Money.

The problems encountered by the underinsured remain in some aspects similar to those encountered by the without insurance, although they are usually much less severe. Uninsurance and underinsurance, however, entail clearly different plan concerns, and the strategies for resolving them may differ. Throughout this study and the 5 reports to follow, the major focus gets on individuals with no medical insurance and thus no assistance in spending for health and wellness care beyond what is available with charity and safety internet establishments.

Medical insurance is a powerful element affecting invoice of care since both clients and physicians react to the out-of-pocket cost of services. Medical insurance, nonetheless, is neither required nor enough to access to clinical solutions. The independent and direct effect of wellness insurance policy protection on access to health and wellness solutions is well developed.

Others will certainly obtain the healthcare they require also without wellness insurance policy, by paying for it out of pocket or seeking it from companies that offer care cost-free or at highly subsidized prices - Final Expense in Toccoa, GA. For still others, medical insurance alone does not make sure invoice of treatment due to the fact that of other nonfinancial barriers, such as a lack of healthcare providers in their area, limited accessibility to transportation, illiteracy, or linguistic and cultural differences

A Biased View of Commercial Insurance In Toccoa, Ga

Official research about without insurance populaces in the USA dates to the late 1920s and early 1930s when the Committee on the Price of Healthcare created a collection of reports regarding funding doctor workplace check outs and hospital stays. This issue ended up being significant as the varieties of medically indigent climbed throughout the Great Clinical depression.

Empirical studies constantly sustain the link between access to care and boosted health outcomes (Bindman et al., 1995; Starfield, 1995). Having a regular source of treatment can be taken into consideration a forecaster of access, instead of a direct procedure of it, when wellness end results are themselves used as access signs. Affordable Care Act (ACA) in Toccoa, GA. This extension of the notion of gain access to measurement was visit this page made by the IOM Committee on Checking Accessibility to Personal Wellness Treatment Services (Millman, 1993, p

Nevertheless, the effect of parents' wellness and wellness insurance on the well-being of their children has actually obtained focus just lately. Whether or not parents are guaranteed appears to influence whether their kids receive treatment as well as just how much careeven if the youngsters themselves have insurance coverage (Hanson, 1998).

Life Insurance In Toccoa, Ga - Questions

Emergency situation departments are represented as an expensive and unacceptable site of main treatment solutions, numerous without insurance patients seek treatment in emergency situation departments since they are sent out there by various other health treatment suppliers or have nowhere else to go. The chapter likewise provides information regarding the threat of being or ending up being without insurance: How does the chance of being uninsured modification depending on chosen characteristics, such as racial and ethnic identity, country or city residency, and age? What are the likelihoods for details populations, such as racial and ethnic minorities, rural homeowners, and older working-age persons, of being uninsured?